News and Information for current and prospective homeowners

Feb 21, 2026

The Real Drivers of Resale Value in a Manufactured Home

It’s not about myths — it’s about the fundamentals For years, the conversation around manufactured homes has centered on one question: Do they depreciate? At Hames Homes, we’ve moved past that — because our homeowners are living the real story every day. Resale value comes down to the same things that drive value in any home: how well it’s cared for, where it’s located, and how desirable it is to today’s buyers. Here’s what actually makes the difference.

Jan 30, 2026

Buying a refurbished home from Hames Homes is a smarter choice than taking on a fixer-upper.

Purchasing a fixer-upper can sound exciting—and affordable—but it often comes with challenges buyers underestimate. Before committing, consider these common downsides.

Dec 19, 2025

Hames Homes is here to help with New Year's Resolutions

New Year’s goals can be inspiring… and sometimes a little intimidating. But if one of your resolutions for 2026 is to live healthier, happier, and more comfortably, a home in a Hames community might be just the place to help you succeed.

Nov 26, 2025

5 Reasons a Hames Home Beats Apartment Living Every Time

When you’re comparing housing options in Eastern Iowa, the choice often comes down to this: keep renting an apartment… or take the step into a home of your own. At Hames Homes, we hear from people every day who are ready for more privacy, more freedom, and more value for their monthly payment. If you’re wondering what makes manufactured homeownership so different from apartment living, here are five real-life advantages our homeowners rave about — every single day.

Oct 21, 2025

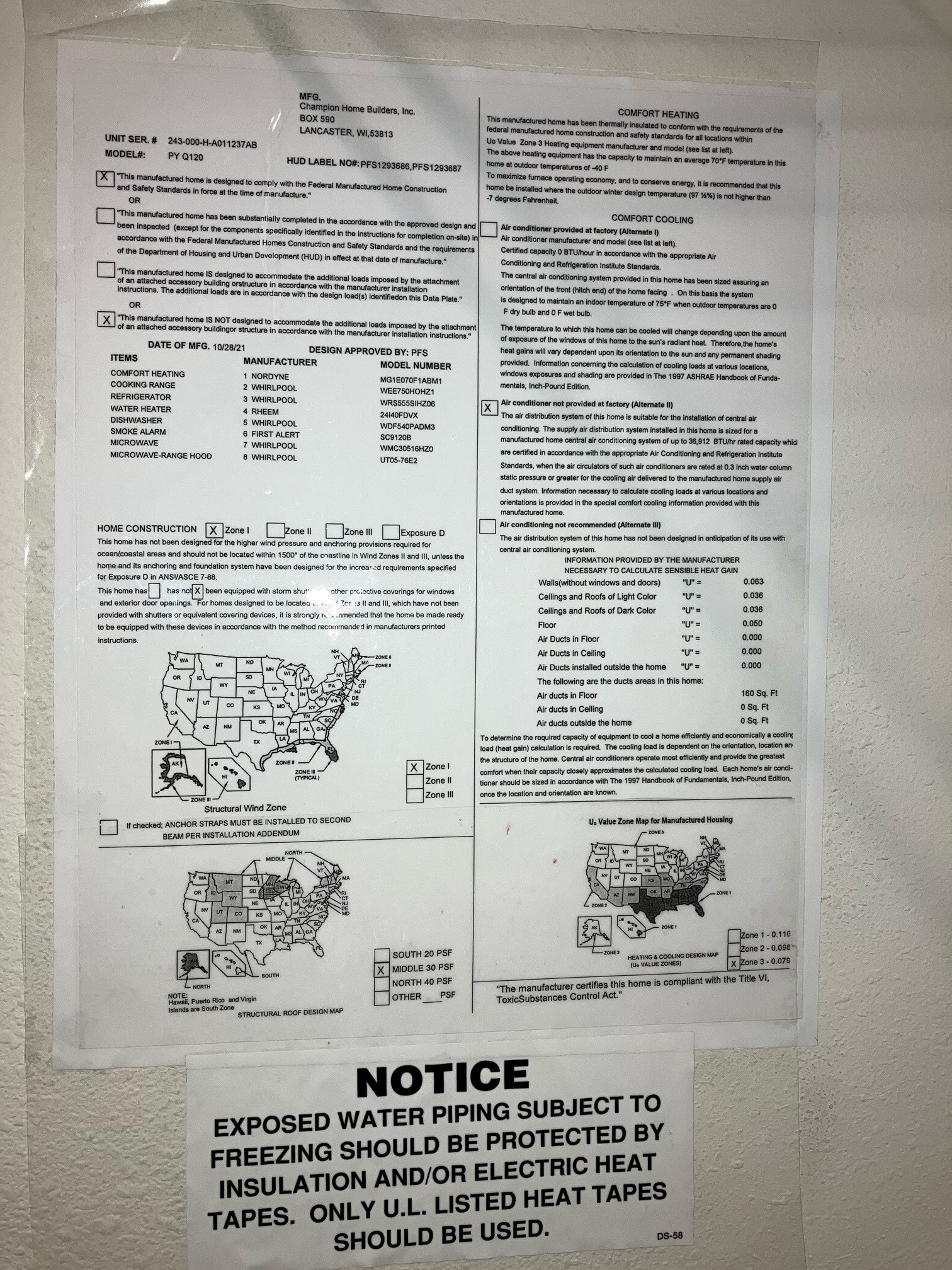

What Is a Data Plate on a Manufactured Home — and Why It Matters

If you’ve ever taken a close look inside your manufactured home, you might have noticed a small white sheet of paper with official-looking information printed on it. That’s your data plate — and it’s an important part of your home’s identity.

Sep 24, 2025

Hames Homes and Garden View Homes at the Cedar Rapids Parade of Homes

We are proud to share that Hames Homes and our sister company, Garden View Homes, are once again partnering with the Greater Cedar Rapids Parade of Homes this fall!

Aug 27, 2025

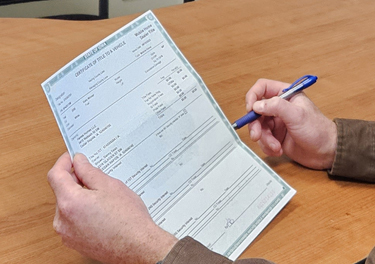

Understanding Manufactured Home Titles in Iowa

Understanding how a title works on a manufactured home can be challenging. We are here to help clarify.

Jul 25, 2025

You Belong in a Hames Home - Part 3: Condo Shoppers and Owners

If you’ve been considering a condo, or already own one, you may want to take a closer look at what a Hames manufactured home has to offer. You might be surprised by just how much more you can get for your money, your lifestyle, and your peace of mind.

Jun 22, 2025

You Belong in a Hames Home - Part 2: Young Families and First-Time Homebuyers

Is the home buying process overwhelming? Struggling to figure out financing and what your actual monthly costs will be? Come see how easy home ownership can be at Hames