Financing Your Manufactured Home - What You Need to Know

November 28, 2023

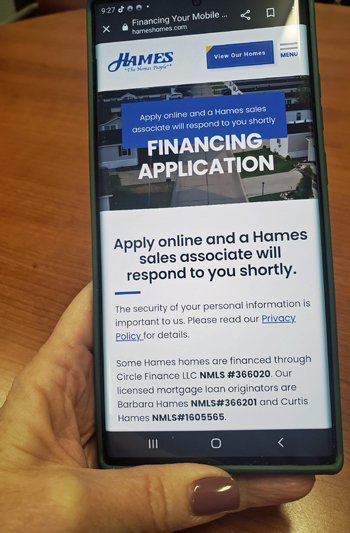

Hames Homes is your “One Stop Shop” for purchasing and financing your next manufactured home. We have new and used mobile and manufactured homes for sale in beautiful neighborhoods. We also guide you through financing options and homeowner’s insurance.

IS GETTING A MOBILE HOME LOAN COMPLICATED?

Knowledgeable Hames manufactured home sales and lending professionals will guide you through the loan process. We’ll compare options from our in-house finance company (Circle Finance LLC NMLS #366020), other local banks, and national lenders. Hames’ licensed loan originators will ensure you’re matched with a loan that suits your needs.

CAN I RENT A HOME IN A HAMES COMMUNITY INSTEAD?

All homes in Grand View and Summit View are owner-occupied. This gives residents incentive to care about home maintenance and the quality of their surroundings. Plus, owning your home allows you to build up equity, something you can never say about renting.

HOW MUCH MONEY DO I NEED TO MOVE INTO A HAMES HOME?

- Down payment – typically 10% or more of the purchase price, and,

- Escrow deposit – your lender will usually require first two months tax and insurance payments, usually no more than $400, and,

- Home site deposit – $455-$505 depending on your lot. All buyers also need to complete a Community Application and be approved to live in Grand View or Summit View.

MY CREDIT ISN’T THE BEST. CAN I REALLY BE APPROVED?

Banks look at more than just credit score. They will evaluate your income, down payment, job situation, and debt-to-income ratio. Applying online is the easiest way to find out if you qualify.

WHAT IS DEBT-TO-INCOME RATIO?

Debt-to-income (DTI) is an indication of how much of your paycheck is going out for expenses. It includes the home loan payment, homeowner taxes and insurance (escrow), home site rent, car payments, credit card payments, or other financial commitments. Ideally, DTI should be no more than 43% of your gross wages for you to live comfortably.

OK IF I BORROW A DOWN PAYMENT?

The down payment is your “skin-in-the-game”. It provides lenders with a degree of security that you want stay in your home and make payments. Some common ways to obtain a down payment are regularly saving part of your paycheck, monetary gifts (not loans) from relatives, or withdrawal from a retirement account, such as 401(k).

HOW LONG DOES IT TAKE TO GET A LOAN?

Once your application is complete, a lender is required to give you an answer in 3 days. Upon approval, you can close on your loan and move into your home as early as 7 days. Since most Hames homes are move-in ready, this is a great option versus the months it takes to complete a site-built home purchase.

HOW DO I GET STARTED?

Apply online at www.hameshomes.com/financing, or visit our sales office at 5410 Wabash St. SW in Cedar Rapids. Bringing your ID and paystubs, or other proof of income, speeds up the process. Our licensed mortgage loan originators will determine your goals and discuss financing options with you.

Call Curtis or Clint today at (319) 377-4863 or email us online for more information.

#HomeSweetHames