Ten Tips for Financing a Mobile or Manufactured Home

October 25, 2022

Interest rates are increasing, but good financing is still available for manufactured homes.

1. When buying a manufactured home, start with as much down payment as possible. Equity will build up faster and payments will be lower.

1. When buying a manufactured home, start with as much down payment as possible. Equity will build up faster and payments will be lower.

2. Always consider taxes and insurance (called “escrow”) when budgeting your monthly loan payment. When a lender quotes a payment for your new loan, ask if it includes taxes and insurance.

3. If you select a non-standard loan, make sure you understand terms like teaser rate, variable rate, or balloon payment.

4. All banks require homeowner’s insurance. Lenders have access to national insurance companies that specialize in mobile home insurance and will generally quote good rates, but don’t be afraid to shop around.

5. Speaking of which, never let your homeowner’s insurance lapse. It will cost several hundred dollars to get the policy reinstated, if that’s even possible, and you’ll likely pay a higher premium.

6. Don’t let a lender tell you “credit life” insurance is required. (This is the insurance that pays off your loan if die or become disabled.) It’s not required, and you may have enough life and short-term disability insurance already.

7. Finance your loan for the shortest time as possible, it will save a TON of money in interest.

8. Interest on mobile and manufactured home loans is tax deductible. It’s your primary dwelling so you get a tax break, the same as real estate. Consult to your tax advisor for more information.

9. Make your payments on time! This sounds simple, but it will improve your credit score and give you more options when you’re ready to upgrade to a newer manufactured home.

10. Before applying online with a national lender, visit your local bank. The bank or credit union where you have your checking account may give you favorable terms on a manufactured home loan, too!

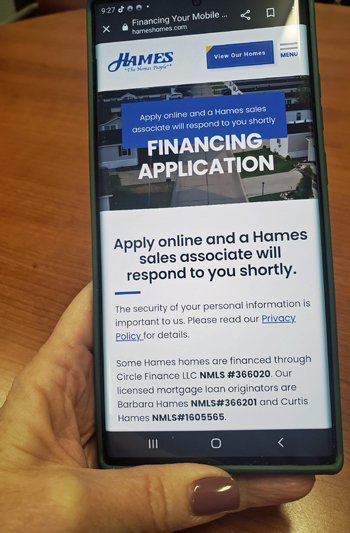

Best advice: work with a reputable retailer like Hames Homes. View Hames’ extensive selection of new and used manufactured homes online at HamesHomes.com. Call (319) 377-4863 and speak with Curtis or Clint about your next home and financing options through Hames in-house loan company Circle Finance LLC (NMLS#366020).